The tax year 2022 individual income tax standard deductions are: Individual Income Tax Standard Deductions

The daily rate for 2022 is the annual rate divided by 365. The monthly rate is the annual rate divided by 12, rounded to the nearest one-tenth of a percentage point. Adding two percentage points results in the annual Department rate of 5.0 percent. Rounded to the nearest whole percent, this average is 3.0 percent. The prime rate averaged 3.25 percent over the past twelve months. Iowa law requires that this average be rounded to the nearest whole percent and two percentage points to be added to it. The annual rate is based on the average monthly prime rate during the preceding twelve month period, October through September.

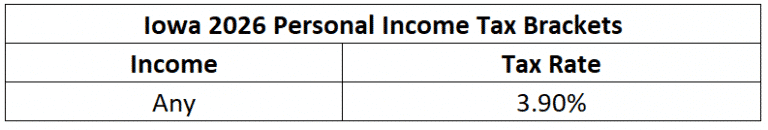

#STATE OF IOWA INCOME TAX BRACKETS 2021 CODE#

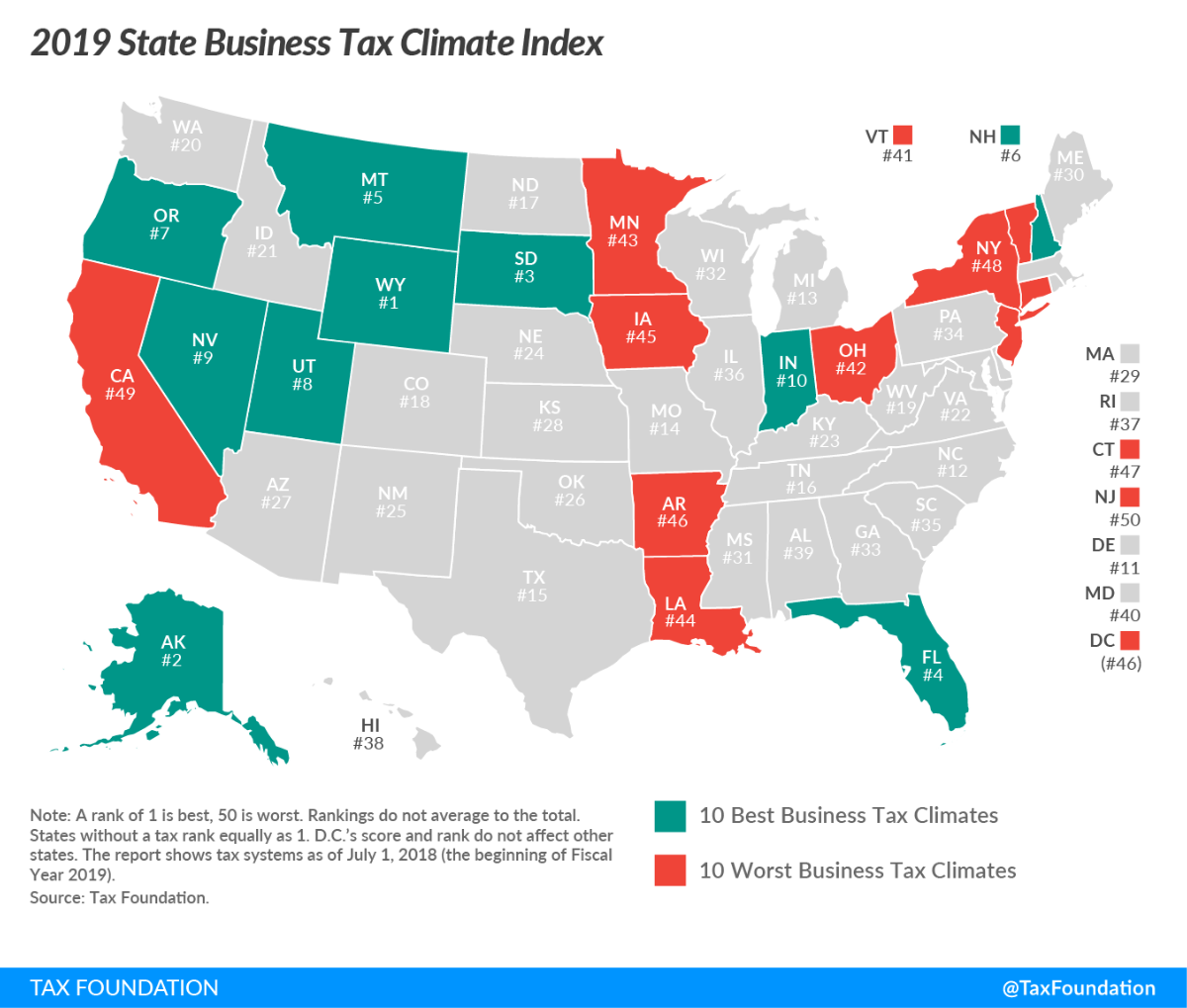

Iowa Code Section 421.7 specifies the procedures for calculating the Department’s annual and monthly interest rates. Starting January 1, 2022, the interest rate for taxpayers with overdue payments will be: John Hendrickson is policy director for the Iowans for Tax Relief Foundation.Des Moines, Iowa – The Iowa Department of Revenue has finalized individual income tax brackets and individual income tax standard deduction amounts for the 2022 tax year (applicable for taxes due in 2023) and the 2022 interest rate, which the agency charges for overdue payments. High property taxes affect both individuals and businesses, and they deserve, and are demanding, property tax relief.Īs big a year as 2023 will be for Iowa taxpayers, it should only be the start of a groundbreaking decade! The Legislature is also poised to make property tax reform a priority for action in 2023. Reynolds and the Legislature understand Iowa is in competition with other states, creating opportunities for further reform, such as lowering the 3.9 percent flat tax rate. The model of wise budgeting and lower tax rates has strengthened the economy and established a strong fiscal foundation for government operations. The Taxpayers Relief Fund will have a balance of $1.6 billion, which is projected to increase.

Iowa is on track for a $1.9 billion budget surplus and $830 million in reserves. The fiscal conservatism of state officials has allowed pro-growth tax reforms. Reynolds and the Legislature have not only made Iowa’s tax code more competitive, but also followed prudent budgeting principles. You will begin to receive our Daily Opinion updates and our topical Pints & Politics newsletter. This is the formula for success: prudent budgeting and gradually lower rates. For several years, North Carolina has been the gold standard in state tax reform, having lowered income tax rates while controlling spending. The United States will benefit by the continued spread of this “revolution,” and states such as Iowa and North Carolina are demonstrating how tax reform can be done responsibly. Doug Burgum, for example, has recently outlined a pro-growth tax reform that, if passed, would create a 1.5 percent flat tax - the lowest in the nation!

Arizona, which will transition from a progressive tax rate system with a top rate of 4.5 percent to a 2.5 percent flat tax.

0 kommentar(er)

0 kommentar(er)